Future value of annuity payments and (optional) initial lump sum receipt.

Syntax: @fv(r, n, x[, v, bf])

r: number

n: integer

x: number

v: (optional) number

bf: (optional) number

Return: number

Compute future (negative) value of payment of an n-period annuity, with payments x and rate r, and optional receipt of (positive) initial lump sum v.

If

n is not an integer, the integer floor

will be used.

A non-zero value for the optional bf indicates that the payments are made at the beginning of periods (annuity due) instead of ends (ordinary annuity).

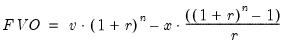

• The future value of an initial lump sum followed by n-periods of ordinary annuity payments:

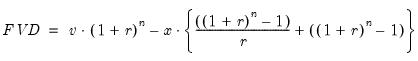

• The future value of an initial lump sum followed by annuity due payments is:

Examples

= @fv(0.05, 10, 100, 1000)

returns the value 371.1054, meaning that the issuer of the annuity stands to profit $371.11 once payments are done.

Cross-references

See also

@nper,

@pmt,

@pv, and

@rate.

will be used.

will be used. will be used.

will be used. will be used.

will be used.