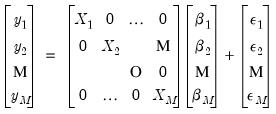

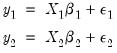

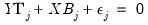

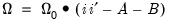

Denote a system of  equations in stacked form as:

equations in stacked form as:

equations in stacked form as:

equations in stacked form as: equations in stacked form as:

equations in stacked form as: | (43.8) |

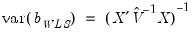

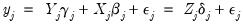

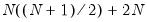

is

is  vector,

vector,  is a

is a  matrix, and

matrix, and  is a

is a  vector of coefficients. The error terms

vector of coefficients. The error terms  have an

have an  covariance matrix

covariance matrix  . The system may be written in compact form as:

. The system may be written in compact form as: | (43.9) |

| (43.10) |

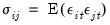

equations. Second, they may be heteroskedastic and contemporaneously correlated. We can characterize both of these cases by defining the

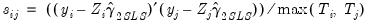

equations. Second, they may be heteroskedastic and contemporaneously correlated. We can characterize both of these cases by defining the  matrix of contemporaneous correlations,

matrix of contemporaneous correlations,  , where the (i,j)-th element of

, where the (i,j)-th element of  is given by

is given by  for all

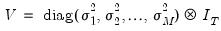

for all  . If the errors are contemporaneously uncorrelated, then,

. If the errors are contemporaneously uncorrelated, then,  for

for  , and we can write:

, and we can write: | (43.11) |

| (43.12) |

| (43.13) |

is an autocorrelation matrix for the i-th and j-th equations.

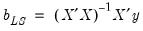

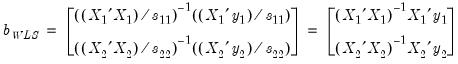

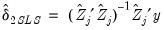

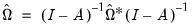

is an autocorrelation matrix for the i-th and j-th equations. . The estimator for

. The estimator for  is given by,

is given by, | (43.14) |

| (43.15) |

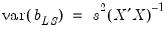

is the residual variance estimate for the stacked system.

is the residual variance estimate for the stacked system. | (43.16) |

is a consistent estimator of

is a consistent estimator of  , and

, and  is the residual variance estimator:

is the residual variance estimator: | (43.17) |

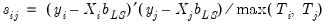

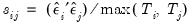

and

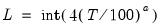

and  . The max function in

Equation (43.17) is designed to handle the case of unbalanced data by down-weighting the covariance terms. Provided the missing values are asymptotically negligible, this yields a consistent estimator of the variance elements. Note also that there is no adjustment for degrees of freedom.

. The max function in

Equation (43.17) is designed to handle the case of unbalanced data by down-weighting the covariance terms. Provided the missing values are asymptotically negligible, this yields a consistent estimator of the variance elements. Note also that there is no adjustment for degrees of freedom. . If you choose not to iterate the weights, the OLS coefficient estimates will be used to estimate the variances. If you choose to iterate the weights, the current parameter estimates (which may be based on the previously computed weights) are used in computing the

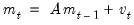

. If you choose not to iterate the weights, the OLS coefficient estimates will be used to estimate the variances. If you choose to iterate the weights, the current parameter estimates (which may be based on the previously computed weights) are used in computing the  . This latter procedure may be iterated until the weights and coefficients converge.

. This latter procedure may be iterated until the weights and coefficients converge. | (43.18) |

| (43.19) |

| (43.20) |

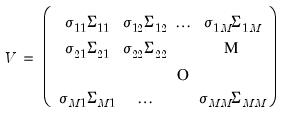

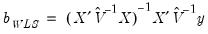

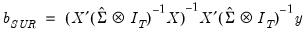

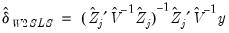

are assumed to be exogenous, and the errors are heteroskedastic and contemporaneously correlated so that the error variance matrix is given by

are assumed to be exogenous, and the errors are heteroskedastic and contemporaneously correlated so that the error variance matrix is given by  . Zellner’s SUR estimator of

. Zellner’s SUR estimator of  takes the form:

takes the form: | (43.21) |

is a consistent estimate of

is a consistent estimate of  with typical element

with typical element  , for all

, for all  and

and  .

. , EViews transforms the model (see

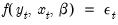

“Specifying AR Terms”) and estimates the following equation:

, EViews transforms the model (see

“Specifying AR Terms”) and estimates the following equation: | (43.22) |

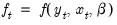

is assumed to be serially independent, but possibly correlated contemporaneously across equations. At the beginning of the first iteration, we estimate the equation by nonlinear LS and use the estimates to compute the residuals

is assumed to be serially independent, but possibly correlated contemporaneously across equations. At the beginning of the first iteration, we estimate the equation by nonlinear LS and use the estimates to compute the residuals  . We then construct an estimate of

. We then construct an estimate of  using

using  and perform nonlinear GLS to complete one iteration of the estimation procedure. These iterations may be repeated until the coefficients and weights converge.

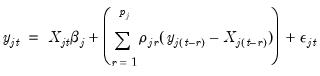

and perform nonlinear GLS to complete one iteration of the estimation procedure. These iterations may be repeated until the coefficients and weights converge. are endogenous. Write the j-th equation of the system as,

are endogenous. Write the j-th equation of the system as, | (43.23) |

| (43.24) |

,

,  ,

,  and

and  .

.  is the matrix of endogenous variables and

is the matrix of endogenous variables and  is the matrix of exogenous variables;

is the matrix of exogenous variables;  is the matrix of endogenous variables not including

is the matrix of endogenous variables not including  .

. on all exogenous variables

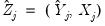

on all exogenous variables  and get the fitted values:

and get the fitted values: | (43.25) |

on

on  and

and  to get:

to get: | (43.26) |

. The residuals from an equation using these coefficients are used for form weights.

. The residuals from an equation using these coefficients are used for form weights. | (43.27) |

is estimated at each step using the current values of the coefficients and residuals.

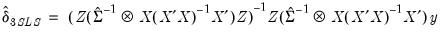

is estimated at each step using the current values of the coefficients and residuals. . This covariance estimator is not, however, consistent if any of the right-hand side variables are endogenous. 3SLS uses the 2SLS residuals to obtain a consistent estimate of

. This covariance estimator is not, however, consistent if any of the right-hand side variables are endogenous. 3SLS uses the 2SLS residuals to obtain a consistent estimate of  .

.  | (43.28) |

has typical element:

has typical element: | (43.29) |

.

. | (43.30) |

is a vector of endogenous variables,

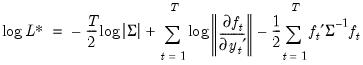

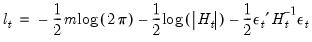

is a vector of endogenous variables,  is a vector of exogenous variables. The Full Information Maximum Likelihood (FIML) estimator finds the vector of parameters

is a vector of exogenous variables. The Full Information Maximum Likelihood (FIML) estimator finds the vector of parameters  by maximizing the likelihood under the assumption that

by maximizing the likelihood under the assumption that  is a vector of i.i.d. multivariate normal random variables with covariance matrix

is a vector of i.i.d. multivariate normal random variables with covariance matrix  .

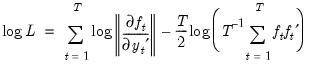

. | (43.31) |

. Note that the log determinant of the derivatives of

. Note that the log determinant of the derivatives of  captures the simultaneity in the system of equations.

captures the simultaneity in the system of equations. | (43.32) |

(or equivalently, the full likelihood with respect to

(or equivalently, the full likelihood with respect to  and the free parameters of

and the free parameters of  ).

). given the user specified value for

given the user specified value for  .

. is asymptotically normally distributed with coefficient covariance typically computed using the partitioned inverse of the outer-product of the gradient of the full likelihood (OPG) or the inverse of the negative of the observed Hessian of the concentrated likelihood. EViews employs the OPG covariance by default, but there is evidence that one should take seriously the choice of method (Calzolari and Panattoni, 1988). In addition, EViews offers a QML covariance computation that employs a Huber-White sandwich using both the OPG and the inverse negative Hessian.

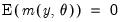

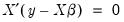

is asymptotically normally distributed with coefficient covariance typically computed using the partitioned inverse of the outer-product of the gradient of the full likelihood (OPG) or the inverse of the negative of the observed Hessian of the concentrated likelihood. EViews employs the OPG covariance by default, but there is evidence that one should take seriously the choice of method (Calzolari and Panattoni, 1988). In addition, EViews offers a QML covariance computation that employs a Huber-White sandwich using both the OPG and the inverse negative Hessian. should satisfy. We denote these moment conditions as:

should satisfy. We denote these moment conditions as: | (43.33) |

| (43.34) |

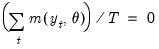

when there are more restrictions

when there are more restrictions  than there are parameters

than there are parameters  . To allow for such overidentification, the GMM estimator is defined by minimizing the following criterion function:

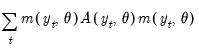

. To allow for such overidentification, the GMM estimator is defined by minimizing the following criterion function: | (43.35) |

and zero.

and zero.  is a weighting matrix that weights each moment condition. Any symmetric positive definite matrix

is a weighting matrix that weights each moment condition. Any symmetric positive definite matrix  will yield a consistent estimate of

will yield a consistent estimate of  . However, it can be shown that a necessary (but not sufficient) condition to obtain an (asymptotically) efficient estimate of

. However, it can be shown that a necessary (but not sufficient) condition to obtain an (asymptotically) efficient estimate of  is to set

is to set  equal to the inverse of the covariance matrix

equal to the inverse of the covariance matrix  of the sample moments

of the sample moments  . This follows intuitively, since we want to put less weight on the conditions that are more imprecise.

. This follows intuitively, since we want to put less weight on the conditions that are more imprecise.  , and a set of instrumental variables,

, and a set of instrumental variables,  , so that:

, so that: | (43.36) |

| (43.37) |

as there are parameters

as there are parameters  . See the section on

“Generalized Method of Moments” for additional examples of GMM orthogonality conditions.

. See the section on

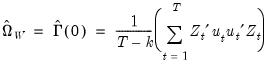

“Generalized Method of Moments” for additional examples of GMM orthogonality conditions. . EViews uses the optimal

. EViews uses the optimal  , where

, where  is the estimated long-run covariance matrix of the sample moments

is the estimated long-run covariance matrix of the sample moments  . EViews uses the consistent TSLS estimates for the initial estimate of

. EViews uses the consistent TSLS estimates for the initial estimate of  in forming the estimate of

in forming the estimate of  .

.  using White’s heteroskedasticity consistent covariance matrix:

using White’s heteroskedasticity consistent covariance matrix: | (43.38) |

is the vector of residuals, and

is the vector of residuals, and  is a

is a  matrix such that the

matrix such that the  moment conditions at

moment conditions at  may be written as

may be written as  .

. by,

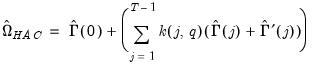

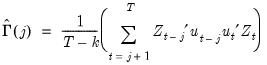

by, | (43.39) |

| (43.40) |

and the bandwidth

and the bandwidth  .

.  is used to weight the covariances so that

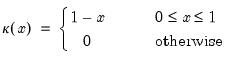

is used to weight the covariances so that  is ensured to be positive semi-definite. EViews provides two choices for the kernel, Bartlett and quadratic spectral (QS). The Bartlett kernel is given by:

is ensured to be positive semi-definite. EViews provides two choices for the kernel, Bartlett and quadratic spectral (QS). The Bartlett kernel is given by: | (43.41) |

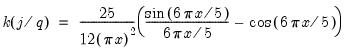

| (43.42) |

. The QS has a faster rate of convergence than the Bartlett and is smooth and not truncated (Andrews 1991). Note that even though the QS kernel is not truncated, it still depends on the bandwidth

. The QS has a faster rate of convergence than the Bartlett and is smooth and not truncated (Andrews 1991). Note that even though the QS kernel is not truncated, it still depends on the bandwidth  (which need not be an integer).

(which need not be an integer).  determines how the weights given by the kernel change with the lags in the estimation of

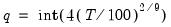

determines how the weights given by the kernel change with the lags in the estimation of  . Newey-West fixed bandwidth is based solely on the number of observations in the sample and is given by:

. Newey-West fixed bandwidth is based solely on the number of observations in the sample and is given by: | (43.43) |

| (43.44) |

and

and  .

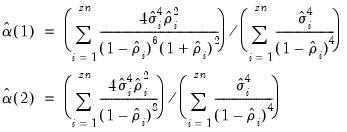

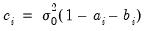

.  and the residual variances

and the residual variances  for

for  . Then

. Then  and

and  are estimated by:

are estimated by: | (43.45) |

.

.  and

and  are estimated by,

are estimated by, | (43.46) |

is a vector of ones and:

is a vector of ones and:  | (43.47) |

.

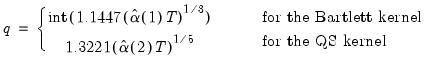

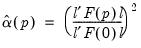

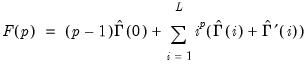

. . The choice of

. The choice of  is arbitrary, subject to the condition that it grow at a certain rate. EViews sets the lag parameter to:

is arbitrary, subject to the condition that it grow at a certain rate. EViews sets the lag parameter to: | (43.48) |

for the Bartlett kernel and

for the Bartlett kernel and  for the quadratic spectral kernel.

for the quadratic spectral kernel. to “soak up” the correlations in

to “soak up” the correlations in  prior to GMM estimation. We first fit a VAR(1) to the sample moments:

prior to GMM estimation. We first fit a VAR(1) to the sample moments: | (43.49) |

of

of  is estimated by

is estimated by  where

where  is the long-run variance of the residuals

is the long-run variance of the residuals  computed using any of the above methods. The GMM estimator is then found by minimizing the criterion function:

computed using any of the above methods. The GMM estimator is then found by minimizing the criterion function: | (43.50) |

| (43.51) |

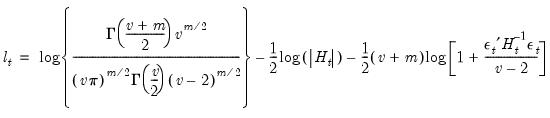

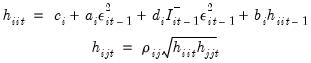

is the

is the  vector of mean equation residuals. For Student's t-distribution, the contributions are of the form:

vector of mean equation residuals. For Student's t-distribution, the contributions are of the form: | (43.52) |

is the estimated degree of freedom.

is the estimated degree of freedom. | (43.53) |

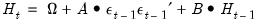

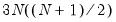

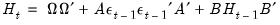

,

,  , and

, and  are

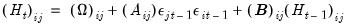

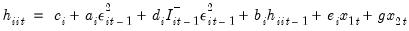

are  symmetric matrices, and the operator “•”is the element by element (Hadamard) product. The coefficient matrices may be parametrized in several ways. The most general way is to allow the parameters in the matrices to vary without any restrictions, i.e. parameterize them as indefinite matrices. In that case the model may be written in single equation format as:

symmetric matrices, and the operator “•”is the element by element (Hadamard) product. The coefficient matrices may be parametrized in several ways. The most general way is to allow the parameters in the matrices to vary without any restrictions, i.e. parameterize them as indefinite matrices. In that case the model may be written in single equation format as: | (43.54) |

is the i-th row and j-th column of matrix

is the i-th row and j-th column of matrix  .

. parameters. This model is the most unrestricted version of a Diagonal VECH model. At the same time, it does not ensure that the conditional covariance matrix is positive semidefinite (PSD). As summarized in Ding and Engle (2001), there are several approaches for specifying coefficient matrices that restrict

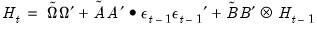

parameters. This model is the most unrestricted version of a Diagonal VECH model. At the same time, it does not ensure that the conditional covariance matrix is positive semidefinite (PSD). As summarized in Ding and Engle (2001), there are several approaches for specifying coefficient matrices that restrict  to be PSD, possibly by reducing the number of parameters. One example is:

to be PSD, possibly by reducing the number of parameters. One example is: | (43.55) |

,

,  , and

, and  are any matrix up to rank

are any matrix up to rank  . For example, one may use the rank

. For example, one may use the rank  Cholesky factorized matrix of the coefficient matrix. This method is labeled the Full Rank Matrix in the coefficient Restriction selection of the system ARCH dialog. While this method contains the same number of parameters as the indefinite version, it does ensure that the conditional covariance is PSD.

Cholesky factorized matrix of the coefficient matrix. This method is labeled the Full Rank Matrix in the coefficient Restriction selection of the system ARCH dialog. While this method contains the same number of parameters as the indefinite version, it does ensure that the conditional covariance is PSD. and guarantees that the conditional covariance is PSD. In this case, the estimated raw matrix is restricted, with all but the first column of coefficients equal to zero.

and guarantees that the conditional covariance is PSD. In this case, the estimated raw matrix is restricted, with all but the first column of coefficients equal to zero. ,

,  , and

, and  . These coefficients must be transformed to obtain the matrix of interest:

. These coefficients must be transformed to obtain the matrix of interest:  ,

,  , and

, and  . These transformed coefficients are reported in the extended variance coefficient section at the end of the system estimation results.

. These transformed coefficients are reported in the extended variance coefficient section at the end of the system estimation results. matrix may be a constant, so that:

matrix may be a constant, so that: | (43.56) |

is a scalar and

is a scalar and  is an

is an  vector of ones. This Scalar specification implies that for a particular term, the parameters of the variance and covariance equations are restricted to be the same. Alternately, the matrix coefficients may be parameterized as Diagonal so that all off diagonal elements are restricted to be zero. In both of these parameterizations, the coefficients are not restricted to be positive, so that

vector of ones. This Scalar specification implies that for a particular term, the parameters of the variance and covariance equations are restricted to be the same. Alternately, the matrix coefficients may be parameterized as Diagonal so that all off diagonal elements are restricted to be zero. In both of these parameterizations, the coefficients are not restricted to be positive, so that  is not guaranteed to be PSD.

is not guaranteed to be PSD. , we may also impose a Variance Target on the coefficients which restricts the values of the coefficient matrix so that:

, we may also impose a Variance Target on the coefficients which restricts the values of the coefficient matrix so that: | (43.57) |

is the unconditional sample variance of the residuals. When using this option, the constant matrix is not estimated, reducing the number of estimated parameters.

is the unconditional sample variance of the residuals. When using this option, the constant matrix is not estimated, reducing the number of estimated parameters. , instead of

, instead of  .

. | (43.58) |

| (43.59) |

is the unconditional variance.

is the unconditional variance. , for every equation. Individual coefficients allow each exogenous variable effect

, for every equation. Individual coefficients allow each exogenous variable effect  to differ across equations.

to differ across equations. | (43.60) |

| (43.61) |

and

and  are unrestricted. However, a common and popular form, diagonal BEKK, may be specified that restricts

are unrestricted. However, a common and popular form, diagonal BEKK, may be specified that restricts  and

and  to be diagonals. This Diagonal BEKK model is identical to the Diagonal VECH model where the coefficient matrices are rank one matrices. For convenience, EViews provides an option to estimate the Diagonal VECH model, but display the result in Diagonal BEKK form.

to be diagonals. This Diagonal BEKK model is identical to the Diagonal VECH model where the coefficient matrices are rank one matrices. For convenience, EViews provides an option to estimate the Diagonal VECH model, but display the result in Diagonal BEKK form.