Background

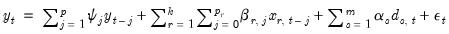

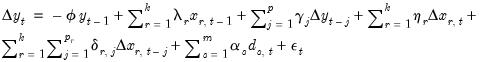

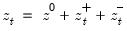

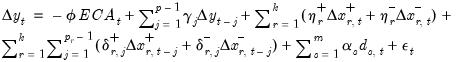

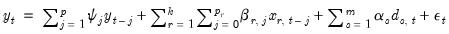

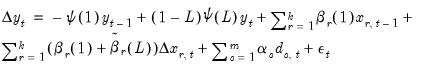

If

is the dependent (autoregressive) variable,

are

distributed-lag explanatory variables, and

are

exogenous, potentially deterministic variables, the

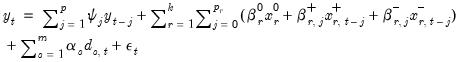

Intertemporal Dynamics (ITD) representation of an ARDL(

) model is given by:

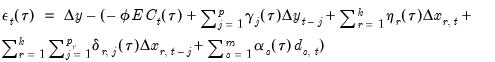

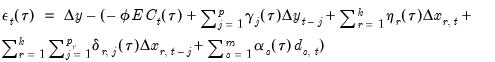

| (29.1) |

where

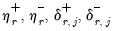

are the innovations, and

,

, and

are the coefficients associated with the exogenous variables,

lags of

, and

lags of the

distributed lag regressors

, respectively.

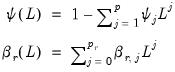

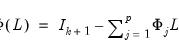

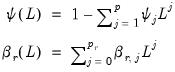

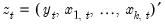

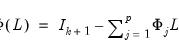

Let

be the usual lag operator and define the lag polynomials:

| (29.2) |

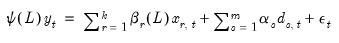

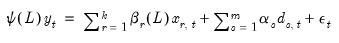

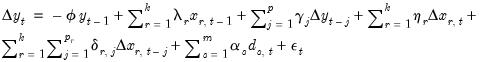

Substituting into

Equation (29.1) yields:

| (29.3) |

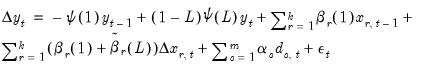

Noting that any series

may be written as

and performing a Beveridge-Nelson decomposition on both

and the

in

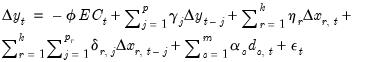

Equation (29.3) produces the

Conditional Error Correction (CEC) representation of the ARDL,

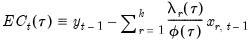

| (29.4) |

which, with a bit of manipulation, may be rewritten as

| (29.5) |

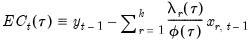

where

| (29.6) |

and

| (29.7) |

Since CEC

Equation (29.5) and

Equation (29.8) are derived from ITD

Equation (29.1), there is an obvious one-to-one correspondence between the two. As with the vector error correction (VEC) form of a VAR, the CEC form offers easy identification of a cointegrating relationship between the dependent variable and the explanatory variables in the ARDL. We discuss this parallel in greater depth in

“Relationship to Vector Error Correction (VEC) Models”.

Rearrange terms, we may re-write

Equation (29.8) as

| (29.8) |

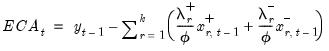

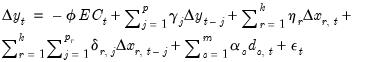

If we define the equilibrium error correction term,

| (29.9) |

then

Equation (29.8) may be written in Error Correction (EC) form:

| (29.10) |

where

is the error correction parameter, and the long-term equilibrium parameters for the explanatory variables are given by

, for

.

Conveniently, the coefficients in both the ITD and the CEC representations of the ARDL model may be estimated via least squares.

Relationship to Vector Error Correction (VEC) Models

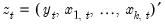

Assuming the same lag across the distributed-lag regressors

and that the deterministics

consist of a simple constant and linear trend, Pesaran (2001) demonstrates that the ARDL CEC representation in

Equation (29.8) is in fact the CEC of the VAR(

) model:

| (29.11) |

where

is a

vector of endogenous variables,

and

are the

vectors of intercept and trend coefficients, respectively, and

| (29.12) |

is the

matrix lag polynomial.

Invoking the BN decomposition on

and with following some rearrangement, the CEC representation of this VEC may be written as

| (29.13) |

where

| (29.14) |

which is equivalent to

Equation (29.5).

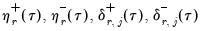

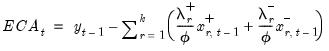

Nonlinear (asymmetric) ARDL

The classical ARDL framework assumes that the long-run relationship

is a symmetric linear combination of regressors. While this is a natural starting assumption, it does not match the behavioral finance and economics literature approach to modeling nonlinearity and asymmetry (Kahneman, Tversky, and Shiller, 1979). In response, Shin (2014) proposes a nonlinear ARDL (NARDL) framework in which short-run and long-run nonlinearities are modeled as positive and negative partial sum decompositions of the explanatory variables.

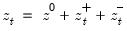

Consider the partial sum decomposition of a variable

around a threshold of

as

where

and

are the partial sum processes of positive and negative

changes in

, respectively:

| (29.15) |

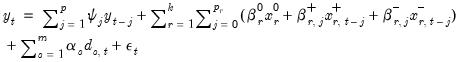

The ITD representation of a NARDL(

) model is given by:

| (29.16) |

where

are coefficients for the initial conditions, and where

and

are coefficients associated with the asymmetric distributed-lag variables.

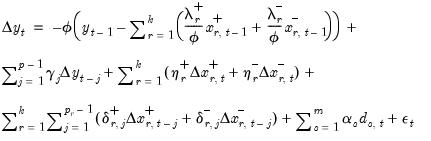

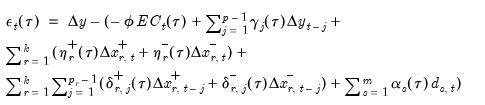

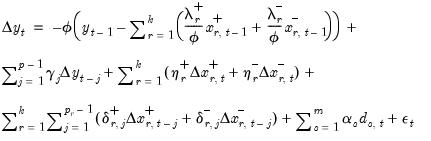

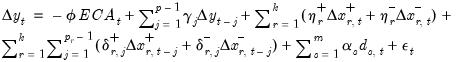

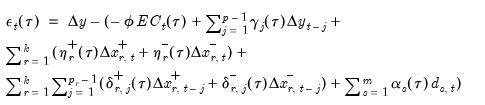

We may an obtain a CEC representation of the ITD NARDL model,

| (29.17) |

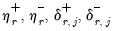

where the

are asymmetric analogues of the coefficients in

Equation (29.6).

We may rearrange terms so that

Equation (29.17) becomes

| (29.18) |

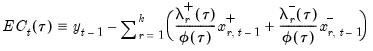

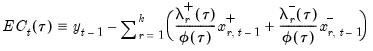

Then, define the asymmetric equilibrium error correction term,

| (29.19) |

so that the CEC

Equation (29.18) may be written in EC form:

| (29.20) |

where

is the error correction parameter, the long-term equilibrium parameters for the explanatory variables are given by

and

for

. The short-run parameters for the explanatory variables are given by the

.

Notice that because the CEC representation decomposes the effect of the distribution lag variables into short and long-run components, it allows for asymmetries in various combinations of short and long-run dynamics. This flexibility does not exist in the ITD representation.

As with their symmetric counterparts, NARDL models may be estimated via least squares. This result is appealing since nonlinear models often require iterative estimation routines. Furthermore, bounds testing procedures (

“Bounds Test View”) remain valid and require no meaningful adjustments.

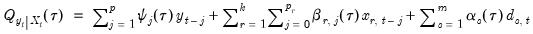

Quantile ARDL (QARDL)

The Quantile Autoregressive Distribued Lag (QARDL) model, introduced by Cho, Kim, and Shin (2015), is an modification of traditional ARDL models to capture the dynamics of conditional quantiles (percentiles) of the dependent variable. While conventional models provide insights into the mean responses of the dependent variable to changes in predictors, QARDL models model the effects of changes in predictors on the quantiles of the dependent variable.

This shift in focus onto quantiles may offer additional insight into the relationship between predictor and dependent variable. While a traditional ARDL model might suggest that an increase in

leads to an average increase in

, the QARDL may reveal that the increase is more pronounced at higher percentiles and subdued at lower ones. This granularity is invaluable in scenarios where the impact of shocks or policy changes might differ across various segments of a distribution.

Similarly, a study of economic policy on income levels will often suggest that certain policies disproportionately benefit higher income brackets (higher quantiles) more than lower brackets (lower quantiles), or vice versa. Likewise, financial markets assessing risk are often interested in extreme behavior which we may model using extreme quantiles (e.g., the 1st or 99th percentile).

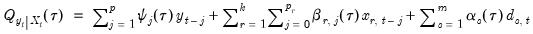

We model the

-th conditional quantile of

as

| (29.21) |

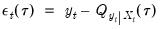

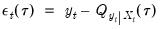

and define the quantile residual as

| (29.22) |

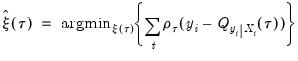

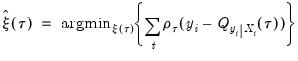

The Quantile Autoregressive Distributed Lag (QARDL) estimator is given by:

| (29.23) |

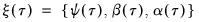

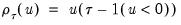

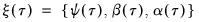

where

and

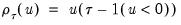

is the so-called

check function which weights positive and negative values asymmetrically.

This conditional quantile specification in

Equation (29.21) is obviously analogous to the traditional ARDL specification for the mean given in

Equation (29.1) and the QARDL model is essentially a traditional ARDL specification estimated using quantile regression (see

“Quantile Regression” for an overview of quantile regression estimation).

Since QARDL is simply a specific case of quantile regression, all of the tools of quantile regression estimation, such as quantile process visualization and quantile equality and symmetry tests, apply in the QARDL framework.

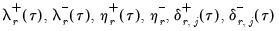

Further, since QARDL is an ARDL model applied to conditional quantiles, conventional ARDL results apply so that standard diagnostic tests, cointegration tests, and error correction mechanisms carry over to QARDL. Notably, since the coefficients defining the Intertemporal Dynamics (ITD) and Conditional Error Correction (CEC) representations of the traditional ARDL model are quantile specific, the QARDL error correction form is given by

| (29.24) |

for error correction term

| (29.25) |

where all of the coefficients are quantile regression analogues for the corresponding coefficients defined in

Equation (29.6) and

Equation (29.7) in the ARDL error correction framework.

Note that quantile regression may also be extended to encompass the Nonlinear ARDL (NARDL) as in

“Nonlinear (asymmetric) ARDL”. The QNARDL analogue of the NARDL error-correction equation

Equation (29.20) is

| (29.26) |

where the quantile error correction term is

| (29.27) |

and the

are asymmetric analogues of the coefficients in

Equation (29.6).

The asymmetric long-run quantile process associated with the distributed-lag variables are

and

. The short-run parameters for the explanatory variables are given by

.

is the dependent (autoregressive) variable,

is the dependent (autoregressive) variable,  are

are  distributed-lag explanatory variables, and

distributed-lag explanatory variables, and  are

are  exogenous, potentially deterministic variables, the Intertemporal Dynamics (ITD) representation of an ARDL(

exogenous, potentially deterministic variables, the Intertemporal Dynamics (ITD) representation of an ARDL( ) model is given by:

) model is given by: is the dependent (autoregressive) variable,

is the dependent (autoregressive) variable,  are

are  distributed-lag explanatory variables, and

distributed-lag explanatory variables, and  are

are  exogenous, potentially deterministic variables, the Intertemporal Dynamics (ITD) representation of an ARDL(

exogenous, potentially deterministic variables, the Intertemporal Dynamics (ITD) representation of an ARDL( ) model is given by:

) model is given by:

are the innovations, and

are the innovations, and  ,

,  , and

, and  are the coefficients associated with the exogenous variables,

are the coefficients associated with the exogenous variables,  lags of

lags of  , and

, and  lags of the

lags of the  distributed lag regressors

distributed lag regressors  , respectively.

, respectively. be the usual lag operator and define the lag polynomials:

be the usual lag operator and define the lag polynomials:

may be written as

may be written as  and performing a Beveridge-Nelson decomposition on both

and performing a Beveridge-Nelson decomposition on both  and the

and the  in

in

is the error correction parameter, and the long-term equilibrium parameters for the explanatory variables are given by

is the error correction parameter, and the long-term equilibrium parameters for the explanatory variables are given by  , for

, for  .

.  and that the deterministics

and that the deterministics  consist of a simple constant and linear trend, Pesaran (2001) demonstrates that the ARDL CEC representation in

consist of a simple constant and linear trend, Pesaran (2001) demonstrates that the ARDL CEC representation in

) model:

) model:

is a

is a  vector of endogenous variables,

vector of endogenous variables,  and

and  are the

are the  vectors of intercept and trend coefficients, respectively, and

vectors of intercept and trend coefficients, respectively, and

matrix lag polynomial.

matrix lag polynomial. and with following some rearrangement, the CEC representation of this VEC may be written as

and with following some rearrangement, the CEC representation of this VEC may be written as

is a symmetric linear combination of regressors. While this is a natural starting assumption, it does not match the behavioral finance and economics literature approach to modeling nonlinearity and asymmetry (Kahneman, Tversky, and Shiller, 1979). In response, Shin (2014) proposes a nonlinear ARDL (NARDL) framework in which short-run and long-run nonlinearities are modeled as positive and negative partial sum decompositions of the explanatory variables.

is a symmetric linear combination of regressors. While this is a natural starting assumption, it does not match the behavioral finance and economics literature approach to modeling nonlinearity and asymmetry (Kahneman, Tversky, and Shiller, 1979). In response, Shin (2014) proposes a nonlinear ARDL (NARDL) framework in which short-run and long-run nonlinearities are modeled as positive and negative partial sum decompositions of the explanatory variables. around a threshold of

around a threshold of  as

as  where

where  and

and  are the partial sum processes of positive and negative

are the partial sum processes of positive and negative  , respectively:

, respectively:

) model is given by:

) model is given by:

are coefficients for the initial conditions, and where

are coefficients for the initial conditions, and where  and

and  are coefficients associated with the asymmetric distributed-lag variables.

are coefficients associated with the asymmetric distributed-lag variables.

are asymmetric analogues of the coefficients in

are asymmetric analogues of the coefficients in

is the error correction parameter, the long-term equilibrium parameters for the explanatory variables are given by

is the error correction parameter, the long-term equilibrium parameters for the explanatory variables are given by  and

and  for

for  . The short-run parameters for the explanatory variables are given by the

. The short-run parameters for the explanatory variables are given by the  .

.  leads to an average increase in

leads to an average increase in  , the QARDL may reveal that the increase is more pronounced at higher percentiles and subdued at lower ones. This granularity is invaluable in scenarios where the impact of shocks or policy changes might differ across various segments of a distribution.

, the QARDL may reveal that the increase is more pronounced at higher percentiles and subdued at lower ones. This granularity is invaluable in scenarios where the impact of shocks or policy changes might differ across various segments of a distribution. -th conditional quantile of

-th conditional quantile of  as

as

and

and  is the so-called

is the so-called

are asymmetric analogues of the coefficients in

are asymmetric analogues of the coefficients in

and

and  . The short-run parameters for the explanatory variables are given by

. The short-run parameters for the explanatory variables are given by  .

.