Testing for Cointegration

In the single equation setting, EViews provides views that perform Engle and Granger (1987) and Phillips and Ouliaris (1990) residual-based tests, Hansen’s instability test (Hansen 1992b), and Park’s

added variables test (Park 1992).

System cointegration testing using Johansen’s methodology is described in

“Johansen Cointegration Test”.

Note that the Engle-Granger and Phillips-Perron tests may also be performed as a view of a Group object.

Residual-based Tests

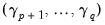

The Engle-Granger and Phillips-Ouliaris residual-based tests for cointegration are simply unit root tests applied to the residuals obtained from SOLS estimation of

Equation (28.1). Under the assumption that the series are

not cointegrated,

all linear combinations of

, including the residuals from SOLS, are unit root nonstationary. Therefore, a test of the

null hypothesis of no cointegration against the

alternative of cointegration corresponds to a unit root test of the null of nonstationarity against the alternative of stationarity.

The two tests differ in the method of accounting for serial correlation in the residual series; the Engle-Granger test uses a parametric, augmented Dickey-Fuller (ADF) approach, while the Phillips-Ouliaris test uses the nonparametric Phillips-Perron (PP) methodology.

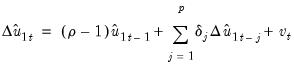

The Engle-Granger test estimates a

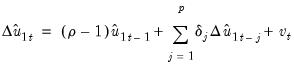

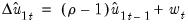

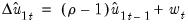

-lag augmented regression of the form

| (28.17) |

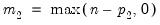

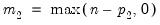

The number of lagged differences

should increase to infinity with the (zero-lag) sample size

but at a rate slower than

.

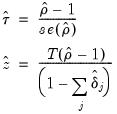

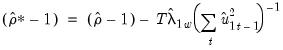

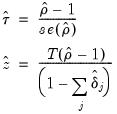

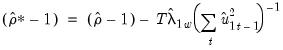

We consider the two standard ADF test statistics, one based on the

t-statistic for testing the null hypothesis of nonstationarity

and the other based directly on the normalized autocorrelation coefficient

:

| (28.18) |

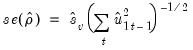

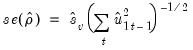

where

is the usual OLS estimator of the standard error of the estimated

| (28.19) |

(Stock 1986, Hayashi 2000). There is a practical question as to whether the standard error estimate in

Equation (28.19) should employ a degree-of-freedom correction. Following common usage, EViews standalone unit root tests and the Engle-Granger cointegration tests both use the d.f.-corrected estimated standard error

, with the latter test offering an option to turn off the correction.

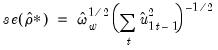

In contrast to the Engle-Granger test, the Phillips-Ouliaris test obtains an estimate of

by running the unaugmented Dickey-Fuller regression

| (28.20) |

and using the results to compute estimates of the long-run variance

and the strict one-sided long-run variance

of the residuals. By default, EViews d.f.-corrects the estimates of both long-run variances, but the correction may be turned off. (The d.f. correction employed in the Phillips-Ouliaris test differs slightly from the ones in FMOLS and CCR estimation since the former applies to the estimators of both long-run variances, while the latter apply only to the estimate of the conditional long-run variance).

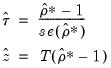

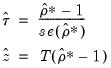

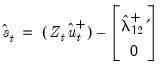

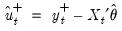

The bias corrected autocorrelation coefficient is then given by

| (28.21) |

The test statistics corresponding to

Equation (28.18) are

| (28.22) |

where

| (28.23) |

As with ADF and PP statistics, the asymptotic distributions of the Engle-Granger and Phillips-Ouliaris

and

statistics are non-standard and depend on the deterministic regressors specification, so that critical values for the statistics are obtained from simulation results. Note that the dependence on the deterministics occurs despite the fact that the auxiliary regressions themselves exclude the deterministics (since those terms have already been removed from the residuals). In addition, the critical values for the ADF and PP test statistics must account for the fact that the residuals used in the tests depend upon estimated coefficients.

MacKinnon (1996) provides response surface regression results for obtaining critical values for four different assumptions about the deterministic regressors in the cointegrating equation (none, constant (level), linear trend, quadratic trend) and values of

from 1 to 12. (Recall that

is the number of cointegrating regressors less the number of deterministic trend regressors excluded from the cointegrating equation.) When computing critical values, EViews will ignore the presence of any user-specified deterministic regressors since corresponding simulation results are not available. Furthermore, results for

will be used for cases that exceed that value.

Continuing with our consumption and income example from Hamilton, we construct Engle-Granger and Phillips-Ouliaris tests from an estimated equation where the deterministic regressors include a constant and linear trend. Since SOLS is used to obtain the first-stage residuals, the test results do not depend on the method used to estimate the original equation, only the specification itself is used in constructing the test.

To perform the Engle-Granger test, open an estimated equation and select select in the dropdown. The dialog will change to display the options for this specifying the number

of augmenting lags in the ADF regression.

By default, EViews uses automatic lag-length selection using the Schwarz information criterion. The default number of lags is the observation-based rule given in

Equation (28.16). Alternately you may specify a lag-length, select a different information criterion (, , , , or ), or specify sequential testing of the highest order lag using a

t-statistic and specified

p-value threshold. For our purposes the default settings suffice so simply click on .

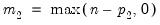

The Engle-Granger test results are divided into three distinct sections. The first portion displays the test specification and settings, along with the test values and corresponding p-values:

The probability values are derived from the MacKinnon response surface simulation results. In settings where using the MacKinnon results may not be appropriate, for example when the cointegrating equation contains user-specified deterministic regressors or when there are more than 12 stochastic trends in the asymptotic distribution, EViews will display a warning message below these results.

Looking at the test description, we first confirm that the test statistic is computed using C and @TREND as deterministic regressors, and note that the choice to include a single lagged difference in the ADF regression was determined using automatic lag selection with a Schwarz criterion and a maximum lag of 13.

As to the tests themselves, the Engle-Granger tau-statistic (t-statistic and normalized autocorrelation coefficient (which we term the z-statistic) both reject the null hypothesis of no cointegration (unit root in the residuals) at the 5% level. In addition, the tau-statistic rejects at a 1% significance level. On balance, the evidence clearly suggests that LC and LY are cointegrated.

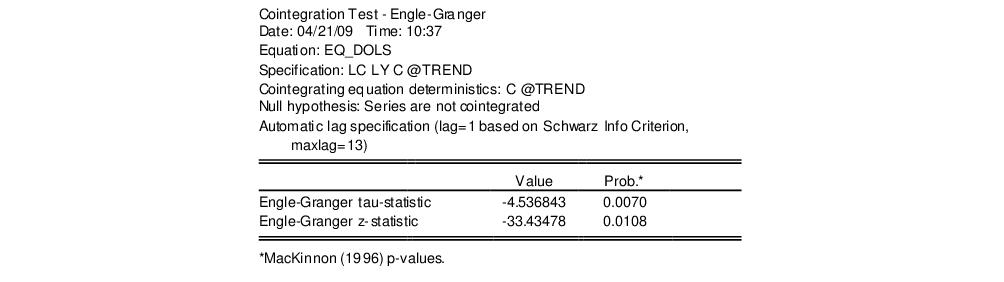

The middle section of the output displays intermediate results used in constructing the test statistic that may be of interest:

Most of the entries are self-explanatory, though a few deserve a bit of discussion. First, the “Rho S.E.” and “Residual variance” are the (possibly) d.f. corrected coefficient standard error and the squared standard error of the regression. Next, the “Long-run residual variance” is the estimate of the long-run variance of the residual based on the estimated parametric model. The estimator is obtained by taking the residual variance and dividing it by the square of 1 minus the sum of the lag difference coefficients. These residual variance and long-run variances are used to obtain the denominator of the

z-statistic (

Equation (28.18)). Lastly, the “Number of stochastic trends” entry reports the

value used to obtain the

p-values. In the leading case,

is simply the number of cointegrating variables (including the dependent) in the system, but the value must generally account for deterministic trend terms in the system that are excluded from the cointegrating equation.

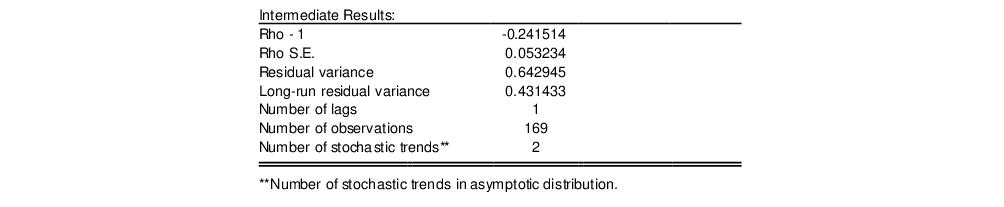

The bottom section of the output depicts the results for the actual ADF test equation:

Alternately, you may compute the Phillips-Ouliaris test statistic. Simply select and choose in the dropdown.

The dialog changes to show a single button for controlling the estimation of the long-run variance

and the strict one-sided long-run variance

. The default settings instruct EViews to compute these long-run variances using a non-prewhitened Bartlett kernel estimator with a fixed Newey-West bandwidth. To change these settings, click on the button and fill out the dialog. Since the default settings are sufficient for our needs, simply click on the button to compute the test statistics.

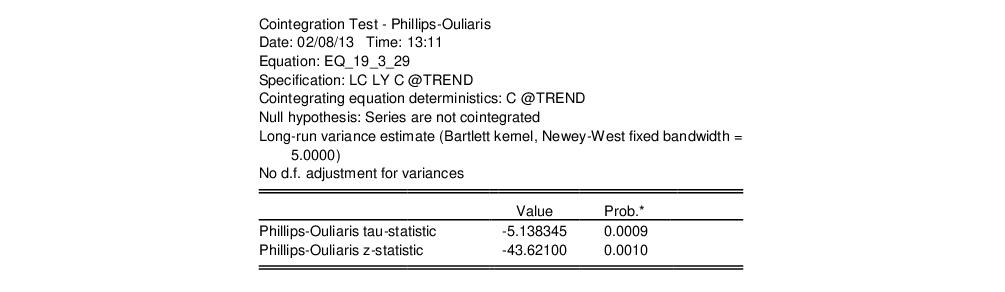

As before, the output may be divided into three parts; we will focus on the first two. The test results are given by:

At the top of the output EViews notes that we estimated the long-run variance and one-sided long run variance using a Bartlett kernel and an number of observations based bandwidth of 5.0. More importantly, the test statistics show that, as with the Engle-Granger tests, the Phillips-Ouliaris tests reject the null hypothesis of no cointegration (unit root in the residuals) at roughly the 1% significance level.

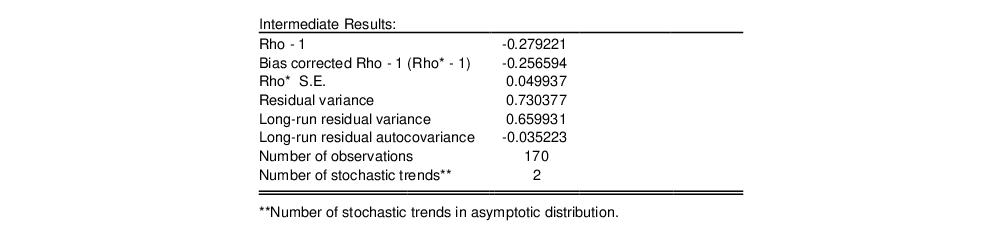

The intermediate results are given by:

There are a couple of new results. The “Bias corrected Rho - 1” reports the estimated value of

Equation (28.21) and the “Rho* S.E.” corresponds to

Equation (28.23). The “Long-run residual variance” and “Long-run residual autocovariance” are the estimates of

and

, respectively. It is worth noting that the ratio of

to the S.E. of the regression, which is a measure of the amount of residual autocorrelation in the long-run variance, is the scaling factor used in adjusting the raw

t-statistic to form tau.

The bottom portion of the output displays results for the test equation.

Hansen’s Instability Test

Hansen (1992) outlines a test of the null hypothesis of cointegration against the alternative of no cointegration. He notes that under the alternative hypothesis of no cointegration, one should expect to see evidence of parameter instability. He proposes (among others) use of the

test statistic, which arises from the theory of Lagrange Multiplier tests for parameter instability, to evaluate the stability of the parameters.

The

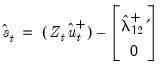

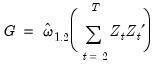

statistic examines time-variation in the scores from the estimated equation. Let

be the vector of estimated individual score contributions from the estimated equation, and define the partial sums,

| (28.24) |

where

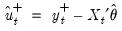

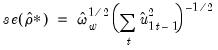

by construction. For FMOLS, we have

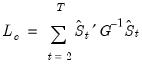

| (28.25) |

where

is the residual for the transformed regression. Then Hansen chooses a constant measure of the parameter instability

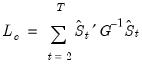

and forms the statistic

| (28.26) |

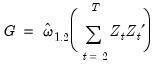

For FMOLS, the natural estimator for

is

| (28.27) |

The

and

may be defined analogously to least squares for CCR using the transformed data. For DOLS

is defined for the subset of original regressors

, and

may be computed using the method employed in computing the original coefficient standard errors.

The distribution of

is nonstandard and depends on

, the number of cointegrating regressors less the number of deterministic trend regressors excluded from the cointegrating equation, and

the number of trending regressors in the system. Hansen (1992) has tabulated simulation results and provided polynomial functions allowing for computation of

p-values for various values of

and

. When computing

p-values, EViews ignores the presence of user-specified deterministic regressors in your equation.

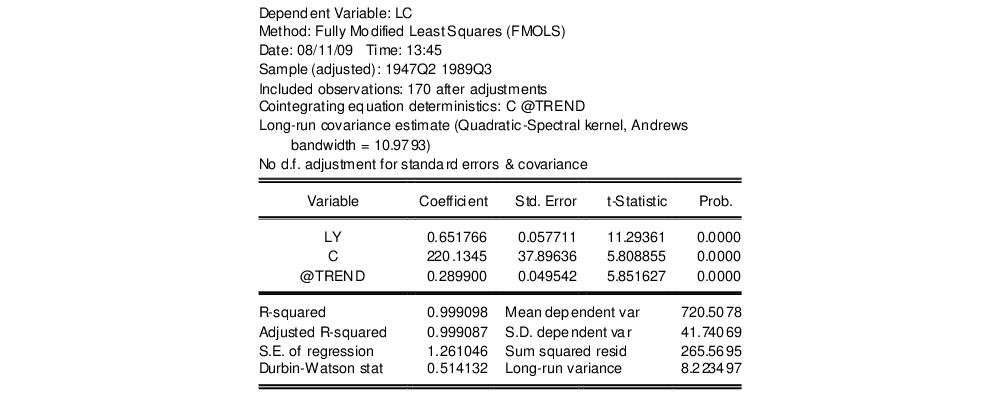

In contrast to the residual based cointegration tests, Hansen’s test does rely on estimates from the original equation. We continue our illustration by considering an equation estimated on the consumption data using a constant and trend, FMOLS with a Quadratic Spectral kernel, Andrews automatic bandwidth selection, and no d.f. correction for the long-run variance and coefficient covariance estimates. The equation estimates are given by:

There are no options for the Hansen test so you may simply click on , select in the dropdown menu, then click on .

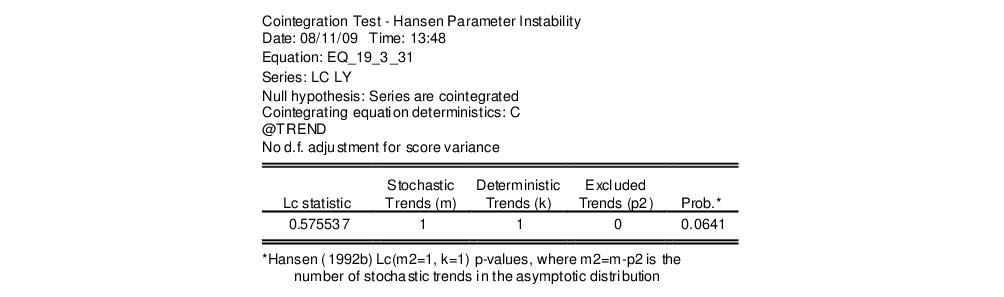

The top portion of the output describes the test hypothesis, the deterministic regressors, and any relevant information about the construction of the score variances. In this case, we see that the original equation had both C and @TREND as deterministic regressors, and that the score variance is based on the usual FMOLS variance with no d.f. correction.

The results are displayed below. The test statistic value of 0.5755 is presented in the first column. The next three columns describe the trends that determine the asymptotic distribution. Here there is a single stochastic regressor (LY) and one deterministic trend (@TREND) in the cointegrating equation, and no additional trends in the regressors equations. Lastly, we see from the final column that the Hansen test does not reject the null hypothesis that the series are cointegrated at conventional levels, though the relatively low p-value are cause for some concern, given the Engle-Granger and Phillips-Ouliaris results.

Park’s Added Variables Test

Park’s

test is an added variable test. The test is computed by testing for the significance of spurious time trends in a cointegrating equation estimated using one of the methods described above.

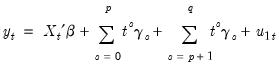

Suppose we estimate equation

Equation (28.1) where, to simplify, we let

consist solely of powers of trend up to order

. Then the Park test estimates the spurious regression model including from

to

spurious powers of trend

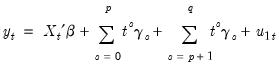

| (28.28) |

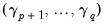

and tests for the joint significance of the coefficients

. Under the null hypothesis of cointegration, the spurious trend coefficients should be insignificant since the residual is stationary, while under the alternative, the spurious trend terms will mimic the remaining stochastic trend in the residual. Note that unless you wish to treat the constant as one of your spurious regressors, it should be included in the original equation specification.

Since the additional variables are simply deterministic regressors, we may apply a joint Wald test of significance to

. Under the maintained hypothesis that the original specification of the cointegrating equation is correct, the resulting test statistic is asymptotically

.

While one could estimate an equation with spurious trends and then to test for their significance using a Wald test, EViews offers a view which performs these steps for you. First estimate an equation where you include all trends that are assumed to be in the cointegrating equation. Next, select and choose in the dropdown menu. The dialog will change to allow you to specify the spurious trends.

There are two parts to the dialog. The dropdown menu allows you to specify a trend polynomial. By default, the dropdown will be set to two orders higher than the trend order in the original equation. In our example equation which includes a linear trend, the default setting will include quadratic and cubic trend terms in the test equation and test for the significance of the two coefficients. You may use the edit field to enter non power-of-trend deterministic regressors.

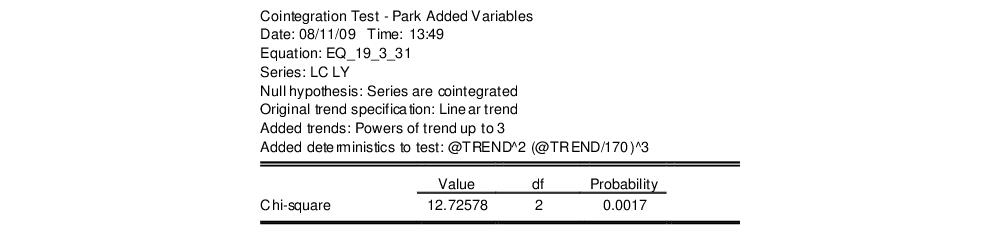

We will use the default settings to perform a Park test on the FMOLS linear trend consumption equation considered previously. The results are presented in two parts: the test specification and test results are displayed at the top of the output, and the results for the test equation (not depicted) are displayed at the bottom:

The null hypothesis is that the series are cointegrated. The original specification includes a constant and linear trend and the test equation will include up to a cubic trend. The Park test evaluates the statistical significance of the @TREND^2 and the (@TREND/170)^3 terms using a conventional Wald test. (You may notice that the latter cubic trend term—and any higher order trends that you may include—uses the trend scaled by the number of observations in the sample.)

The test results reject the null hypothesis of cointegration, in direct contrast to the results for the Engle-Granger, Phillips-Ouliarias, and Hansen tests (though the latter, which also tests the null of cointegration, is borderline). Note however, adding a quadratic trend to the original equation and then testing for cointegration yields results that, for all four tests, point to cointegration between LC and LY.

added variables test (Park 1992).

added variables test (Park 1992).  added variables test (Park 1992).

added variables test (Park 1992).  , including the residuals from SOLS, are unit root nonstationary. Therefore, a test of the

, including the residuals from SOLS, are unit root nonstationary. Therefore, a test of the  -lag augmented regression of the form

-lag augmented regression of the form

should increase to infinity with the (zero-lag) sample size

should increase to infinity with the (zero-lag) sample size  but at a rate slower than

but at a rate slower than  .

. and the other based directly on the normalized autocorrelation coefficient

and the other based directly on the normalized autocorrelation coefficient  :

:

is the usual OLS estimator of the standard error of the estimated

is the usual OLS estimator of the standard error of the estimated

, with the latter test offering an option to turn off the correction.

, with the latter test offering an option to turn off the correction. by running the unaugmented Dickey-Fuller regression

by running the unaugmented Dickey-Fuller regression

and the strict one-sided long-run variance

and the strict one-sided long-run variance  of the residuals. By default, EViews d.f.-corrects the estimates of both long-run variances, but the correction may be turned off. (The d.f. correction employed in the Phillips-Ouliaris test differs slightly from the ones in FMOLS and CCR estimation since the former applies to the estimators of both long-run variances, while the latter apply only to the estimate of the conditional long-run variance).

of the residuals. By default, EViews d.f.-corrects the estimates of both long-run variances, but the correction may be turned off. (The d.f. correction employed in the Phillips-Ouliaris test differs slightly from the ones in FMOLS and CCR estimation since the former applies to the estimators of both long-run variances, while the latter apply only to the estimate of the conditional long-run variance).

and

and  statistics are non-standard and depend on the deterministic regressors specification, so that critical values for the statistics are obtained from simulation results. Note that the dependence on the deterministics occurs despite the fact that the auxiliary regressions themselves exclude the deterministics (since those terms have already been removed from the residuals). In addition, the critical values for the ADF and PP test statistics must account for the fact that the residuals used in the tests depend upon estimated coefficients.

statistics are non-standard and depend on the deterministic regressors specification, so that critical values for the statistics are obtained from simulation results. Note that the dependence on the deterministics occurs despite the fact that the auxiliary regressions themselves exclude the deterministics (since those terms have already been removed from the residuals). In addition, the critical values for the ADF and PP test statistics must account for the fact that the residuals used in the tests depend upon estimated coefficients. from 1 to 12. (Recall that

from 1 to 12. (Recall that  is the number of cointegrating regressors less the number of deterministic trend regressors excluded from the cointegrating equation.) When computing critical values, EViews will ignore the presence of any user-specified deterministic regressors since corresponding simulation results are not available. Furthermore, results for

is the number of cointegrating regressors less the number of deterministic trend regressors excluded from the cointegrating equation.) When computing critical values, EViews will ignore the presence of any user-specified deterministic regressors since corresponding simulation results are not available. Furthermore, results for  will be used for cases that exceed that value.

will be used for cases that exceed that value. of augmenting lags in the ADF regression.

of augmenting lags in the ADF regression.

value used to obtain the

value used to obtain the  is simply the number of cointegrating variables (including the dependent) in the system, but the value must generally account for deterministic trend terms in the system that are excluded from the cointegrating equation.

is simply the number of cointegrating variables (including the dependent) in the system, but the value must generally account for deterministic trend terms in the system that are excluded from the cointegrating equation.

and the strict one-sided long-run variance

and the strict one-sided long-run variance  . The default settings instruct EViews to compute these long-run variances using a non-prewhitened Bartlett kernel estimator with a fixed Newey-West bandwidth. To change these settings, click on the

. The default settings instruct EViews to compute these long-run variances using a non-prewhitened Bartlett kernel estimator with a fixed Newey-West bandwidth. To change these settings, click on the

and

and  , respectively. It is worth noting that the ratio of

, respectively. It is worth noting that the ratio of  to the S.E. of the regression, which is a measure of the amount of residual autocorrelation in the long-run variance, is the scaling factor used in adjusting the raw

to the S.E. of the regression, which is a measure of the amount of residual autocorrelation in the long-run variance, is the scaling factor used in adjusting the raw  test statistic, which arises from the theory of Lagrange Multiplier tests for parameter instability, to evaluate the stability of the parameters.

test statistic, which arises from the theory of Lagrange Multiplier tests for parameter instability, to evaluate the stability of the parameters. statistic examines time-variation in the scores from the estimated equation. Let

statistic examines time-variation in the scores from the estimated equation. Let  be the vector of estimated individual score contributions from the estimated equation, and define the partial sums,

be the vector of estimated individual score contributions from the estimated equation, and define the partial sums,

by construction. For FMOLS, we have

by construction. For FMOLS, we have

is the residual for the transformed regression. Then Hansen chooses a constant measure of the parameter instability

is the residual for the transformed regression. Then Hansen chooses a constant measure of the parameter instability  and forms the statistic

and forms the statistic

is

is

and

and  may be defined analogously to least squares for CCR using the transformed data. For DOLS

may be defined analogously to least squares for CCR using the transformed data. For DOLS  is defined for the subset of original regressors

is defined for the subset of original regressors  , and

, and  may be computed using the method employed in computing the original coefficient standard errors.

may be computed using the method employed in computing the original coefficient standard errors. is nonstandard and depends on

is nonstandard and depends on  , the number of cointegrating regressors less the number of deterministic trend regressors excluded from the cointegrating equation, and

, the number of cointegrating regressors less the number of deterministic trend regressors excluded from the cointegrating equation, and  the number of trending regressors in the system. Hansen (1992) has tabulated simulation results and provided polynomial functions allowing for computation of

the number of trending regressors in the system. Hansen (1992) has tabulated simulation results and provided polynomial functions allowing for computation of  and

and  . When computing

. When computing

test is an added variable test. The test is computed by testing for the significance of spurious time trends in a cointegrating equation estimated using one of the methods described above.

test is an added variable test. The test is computed by testing for the significance of spurious time trends in a cointegrating equation estimated using one of the methods described above. consist solely of powers of trend up to order

consist solely of powers of trend up to order  . Then the Park test estimates the spurious regression model including from

. Then the Park test estimates the spurious regression model including from  to

to  spurious powers of trend

spurious powers of trend

. Under the null hypothesis of cointegration, the spurious trend coefficients should be insignificant since the residual is stationary, while under the alternative, the spurious trend terms will mimic the remaining stochastic trend in the residual. Note that unless you wish to treat the constant as one of your spurious regressors, it should be included in the original equation specification.

. Under the null hypothesis of cointegration, the spurious trend coefficients should be insignificant since the residual is stationary, while under the alternative, the spurious trend terms will mimic the remaining stochastic trend in the residual. Note that unless you wish to treat the constant as one of your spurious regressors, it should be included in the original equation specification. . Under the maintained hypothesis that the original specification of the cointegrating equation is correct, the resulting test statistic is asymptotically

. Under the maintained hypothesis that the original specification of the cointegrating equation is correct, the resulting test statistic is asymptotically  .

.